The personal and professional finances of an entrepreneur are often closely related. Here, private banker Eileen Redmond-Macken answers real money management questions from our network.

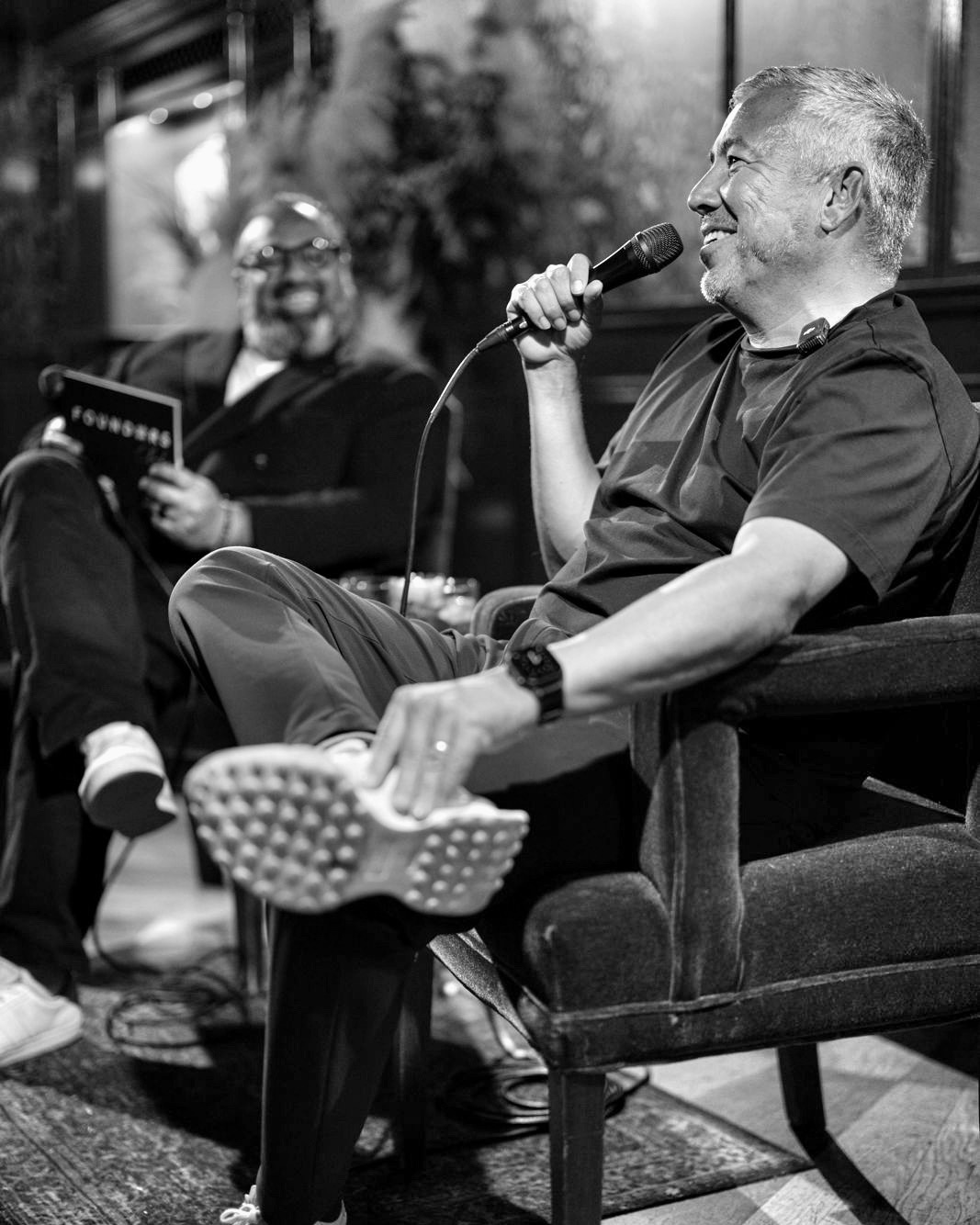

NICK MODHA, Trustist:

For business owners balancing company growth with personal wealth creation, what are the most overlooked strategies to ensure long-term financial security?

The best starting point for any entrepreneur is to find the right financial partner who understands your unique journey. A private banker will take the time to assess your circumstances and goals, providing support through good and bad times. They can also work holistically across your personal and business interests to tailor the services you need.

Typically overlooked strategies include leveraging tax-efficient investment vehicles, such as ISAs and pensions, which can enhance wealth while providing tax relief. Additionally, family trusts can help preserve wealth for future generations.

Strategic borrowing against your personal and business balance sheets is another effective way to grow your wealth.

Finally, regular financial reviews with your financial partner are essential to adapt your strategy as economic conditions change.

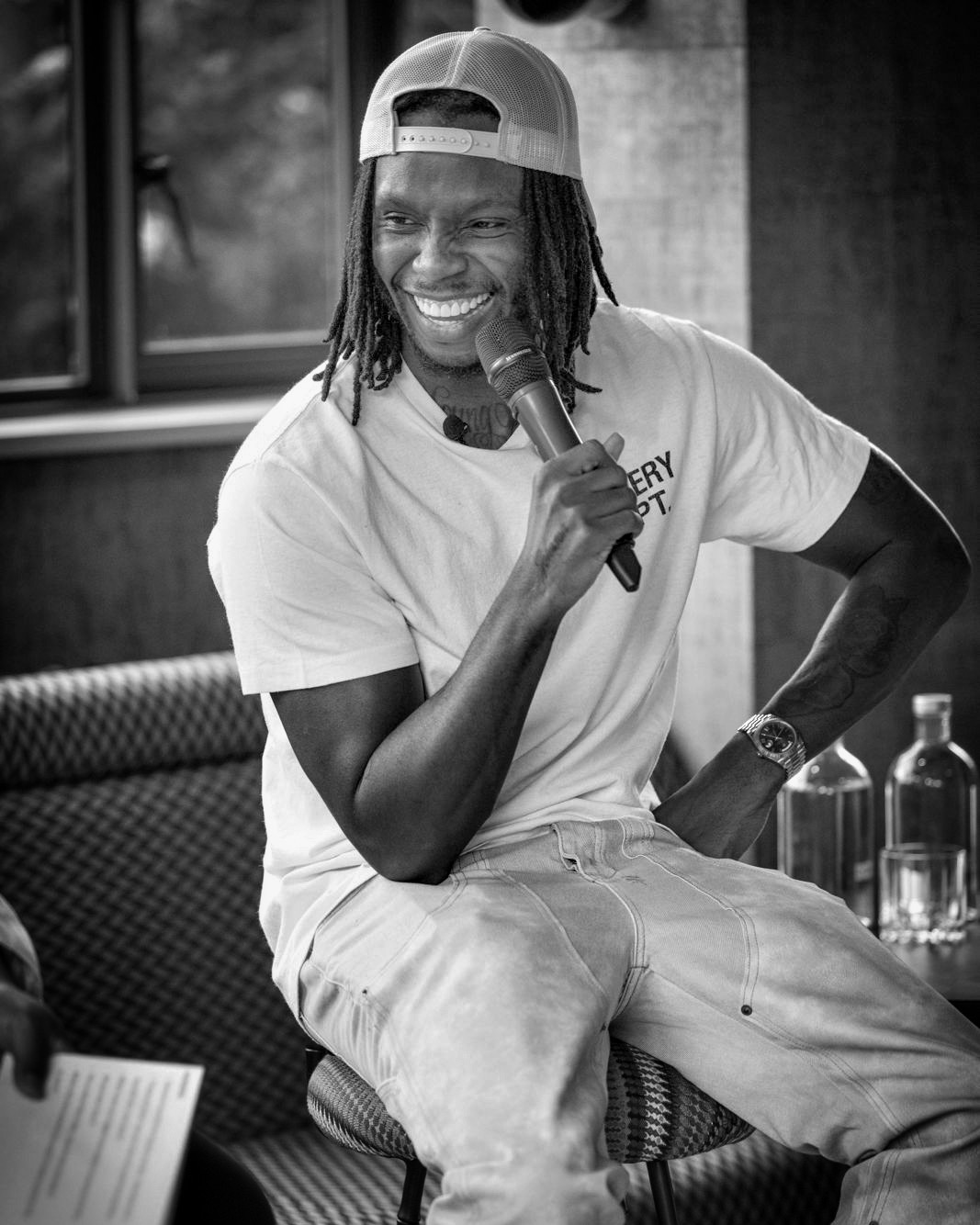

VANJA LJEVAR, Kubik Intelligence:

How can entrepreneurs manage their money when liquidity events are uncertain in timing and scale?

Finding a bank with a refreshingly human approach is key. At Investec, we personalise our solutions. We might take a long-term view of a client’s financial position to determine an appropriate loan amount or align their mortgage repayments with their irregular cash flow.

From a savings perspective, maintaining access to cash for everyday needs is important, so it’s worth exploring the options available to you. A notice deposit account (such as Investec’s Voyage Reserve account) allows you to earn an attractive interest rate on your existing cash, while making withdrawals with a notice period.

There are also tools that can provide more predictability and control over your money. A Foreign Exchange Forward contract allows you to secure an exchange rate up to two years in advance, which would allow you to confirm the value of proceeds in a foreign currency, ahead of time.

MIT PATEL, Thrift Investments:

Can a high-net-worth individual raise funding for a new venture using their existing assets as collateral?

There are three main ways to raise equity-based capital, and at Investec, we can help connect the dots.

Firstly, individuals with liquid securities (such as stocks and shares) may be able to borrow against their portfolio's value without selling the underlying assets and incurring tax liabilities. This is usually an efficient and affordable form of borrowing. Secondly, property owners can secure a mortgage against their homes. Finally, individuals with established private business interests, may be able to borrow against this equity.

While many lenders offer these services, Investec can take a flexible view across asset types to create a personalised and blended solution for each client.

RUCHIRA TALWAR, Foundxrs Club:

How can a small business protect itself from fraud while allowing employees to make payments using company funds?

Start by educating employees about different types of fraud and relevant warning signs. Training should encourage vigilance and reporting of suspicious requests.

It’s essential to have strong internal controls. Limit access to sensitive information and systems to those who need it. Separate duties during fund transfers, conduct regular financial reviews and audits, and require dual authorisation for significant transactions to minimise fraud risk.

Finally, always verify payment requests, especially for large or unusual transactions.

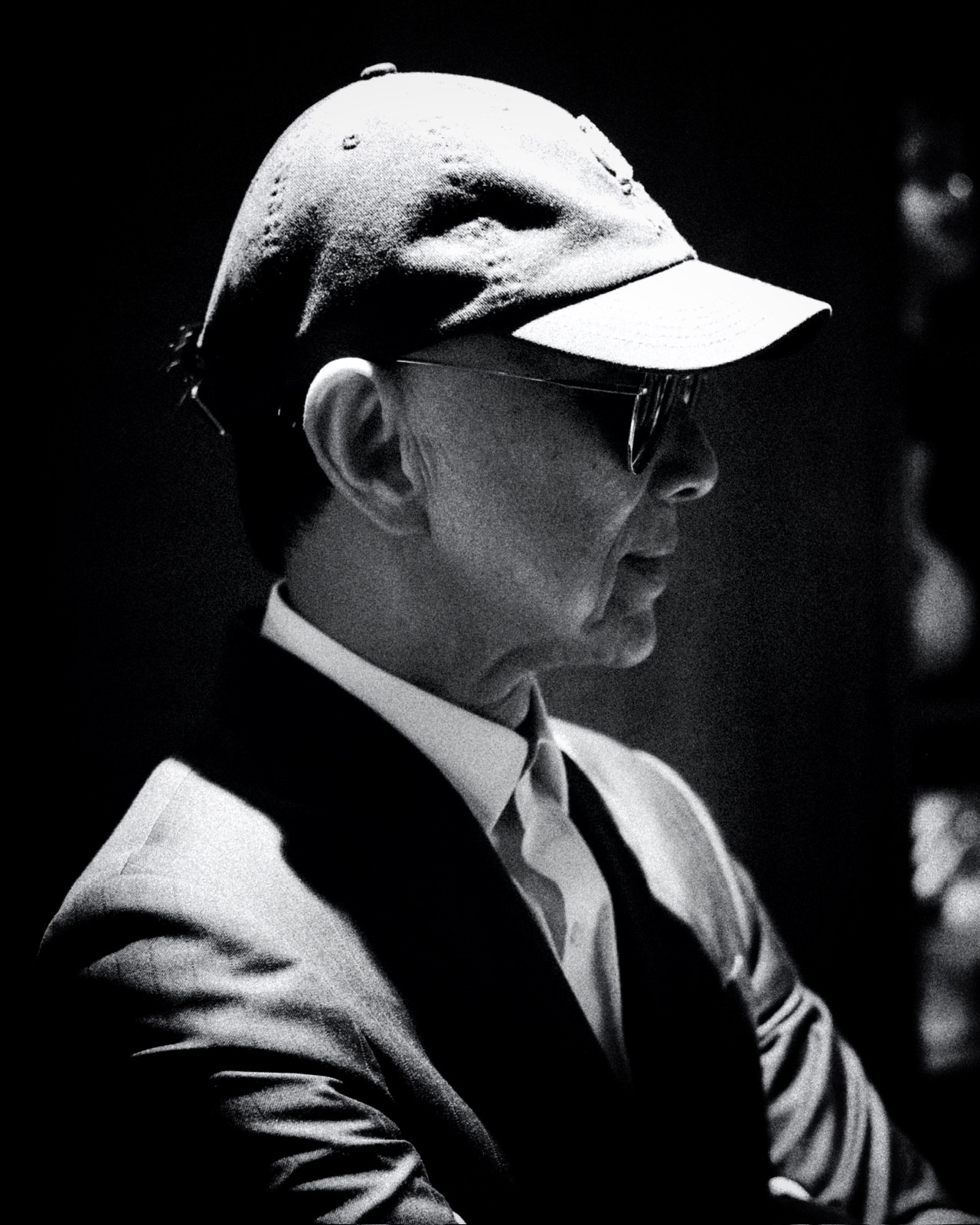

SHYAM PATEL, Stimpsons Eves:

Our business model focuses on acquiring established companies within our industry, integrating them into our portfolio and scaling their operations. What types of funding options are available to support our continued growth by acquisition strategy?

Capital to facilitate acquisitions can include committed or uncommitted facilities. Committed facilities guarantee available funding for a specific timeframe, but could come at a higher cost.

The level of commitment is often dictated by a lender’s belief in the quality of the pipeline. There may also be controls around how the capital can be used and when it can be drawn, as well as mechanisms that adjust the agreement depending on company performance.

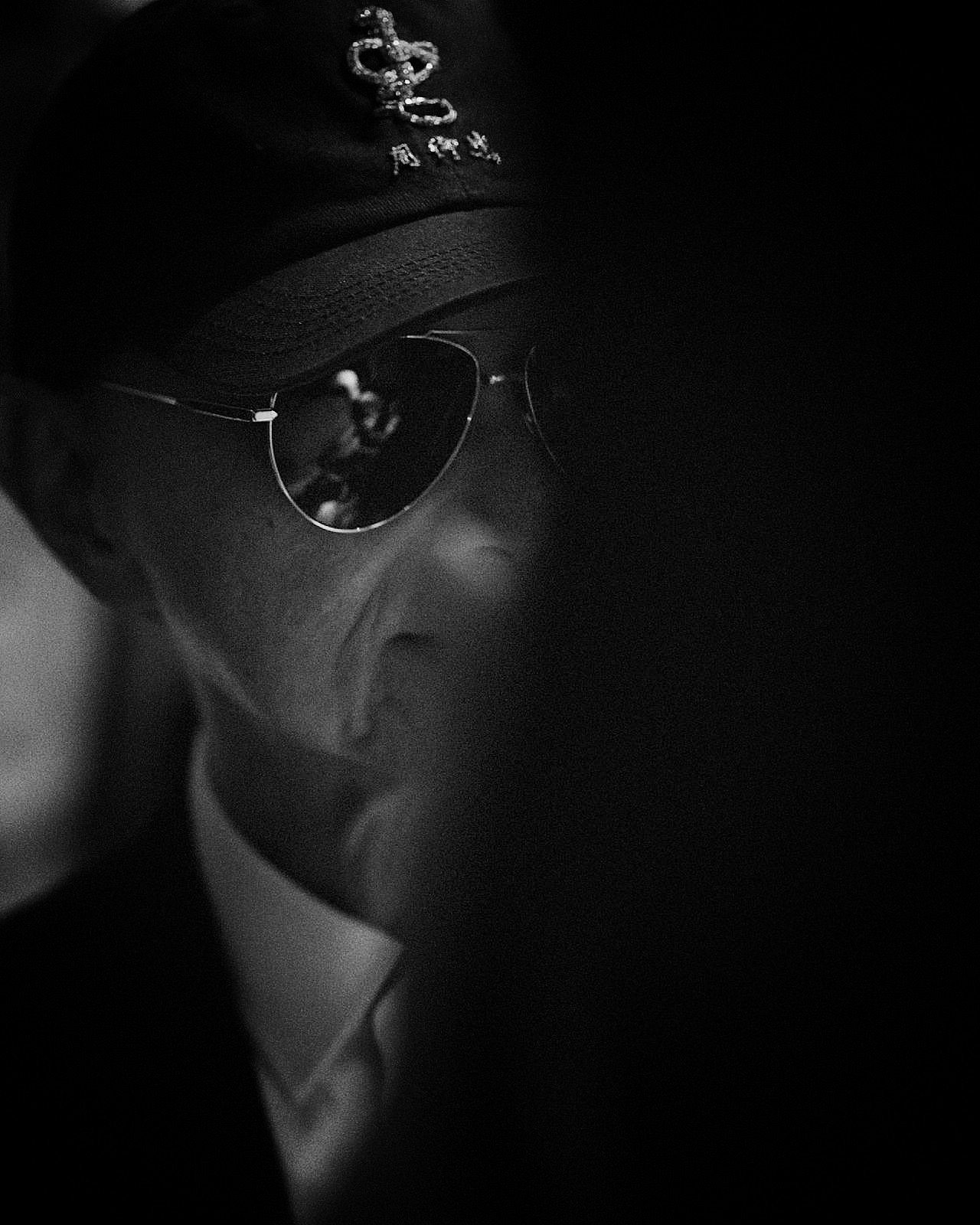

ANITA KALRA, Kalra Legal Group:

Managing a business, taking drawings, and reinvesting funds can be a juggling act. Is there a blueprint that an entrepreneur should follow?

Our working capital team supports businesses with cash flow management. Here are nine steps they recommend:

· Set clear financial goals: Define what you want to achieve financially, both personally and for your business.

· Create a detailed budget: Outline all income sources and expenses, including personal drawings, and keep it updated.

· Monitor cash flow: Regularly check your cash flow to understand how money moves in and out of your business.

· Develop a drawing strategy: Decide how often you’ll take personal drawings and ensure they don’t disrupt business cash flow.

· Plan for reinvestment: Determine a percentage of profits to reinvest in growth areas.

· Build an emergency fund: Set aside profits for unexpected expenses.

· Choose the right accountant or adviser: Work with a qualified accountant familiar with your industry.

· Review your finances regularly: Conduct monthly or quarterly reviews of your financial performance.

· Invest in your own development: Attend workshops or training sessions to enhance your business knowledge

Investec is a leading international bank which provides private, corporate and investment banking to individuals and businesses. For more information, please contact Eileen Redmond at EileenRM@investec.com

Important information: This article is for general information purposes only and should not be used or relied upon as professional advice. It is advisable to contact a professional adviser if you need financial advice.

Minimum eligibility criteria and terms and conditions apply.

Your property may be repossessed if you do not keep up repayments on your mortgage. Investec residential mortgages are only available for residential properties in England or Wales, primarily available to UK residents and subject to eligibility.

Portfolio loans are secured against your investments with Investec Wealth &Investment (UK), which is a subsidiary of Rathbones Group Plc. There are a limited number of situations where the lending purpose may determine our ability to lend. Portfolio loans are repayable on demand.'

You can only book an FX Forward which is for an underlying personal or commercial spending purpose. You cannot book an FX Forward for investment or speculative purposes, for example in order to achieve a gain based on movements in exchange rates. Also, you

cannot book an FX Forward on behalf of any other person. Additional terms and eligibility criteria apply for FX Forwards.

Investec Wealth & Investment (UK) is a trading name of Investec Wealth & Investment Limited, which is a subsidiary of Rathbones Group Plc. Investec Wealth & Investment Limited is authorised and regulated by the Financial Conduct Authority and is registered in England. Registered No. 2122340. Registered Office: 30 Gresham Street. London, EC2V 7QN.